There are tons of pieces of financial advice I could throw at you. None of it magical and all of it you have heard 9 million times. Don’t spend more than you make! Create a budget! You’ll have so much $$$ if you stop the Starbucks runs! We have all heard them. Repeatedly.

HOWEVER, the NUMBER ONE piece of financial advice I can give anyone and everyone, is to understand compounding interest. Before you decide this is a math lesson (and you have always hated math) wait for it. It is the main reason I have money. It is the same reason all successful investors have money. And it is NOT HARD TO UNDERSTAND. (For context, a few months ago I read an article about how few people have retirement savings. I then felt it was my responsibility to lecture my 15yo daughter on compounding interest, so yes, that happened).

Compounding interest, is the simple concept that you save money, earn interest, and together, they both continue to grow. Keeping it basic, you save $100, earn 5% interest ($5), and now it’s $105. Leave the $105 there another year, and now it is $110.25. Obvious, and easy, right?

BUT THE FASCINATING PART, THE REAL MAGIC, IS WHEN TIME IS ON YOUR SIDE.

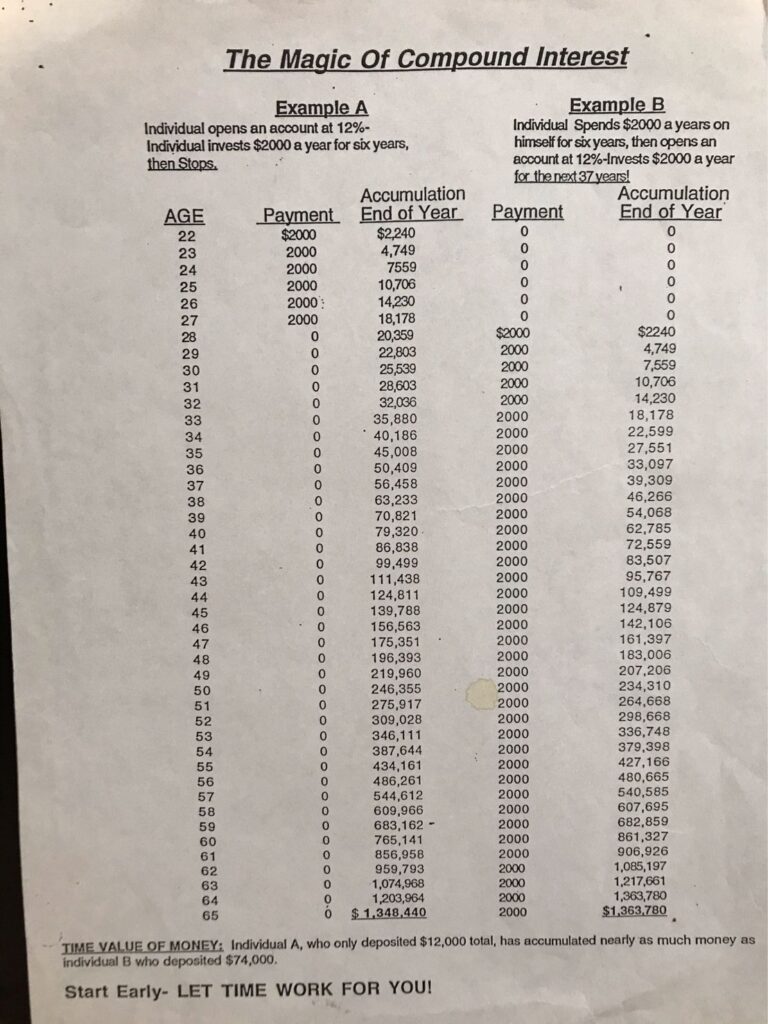

Let’s look at this not so fancy, but super effective example. This chart was created by a teacher I think way back when. (There are tons of examples on the internet-search compounding interest charts and you can get many way fancier. I liked this one because of its simplicity).

The Magic of Compounding Interest:

The first column shows an individual investing $2,000 a year for 6 years-and then STOPS. The money sits there, and keeps growing. When that same individual, hits retirement at 65, the $12,000 that was initially spent, is now $1,348,440. Read that again. $12,000 became over $1.3 million by SITTING THERE.

Column B, shows someone who decided not to invest for 6 years, and instead, started investing at age 28 (instead of 22). Over the course of their life, they then invested $74,000 ($2,000 every year between the ages of 28 and 65). At retirement, they now have $1,363,780. About $15,000 more than the first scenario, even though they invested $62,000 more.

The one flaw in this example is most people don’t get a 12% return in the market consistently. (The average over the last 50 years if you invest is 7%). But it really doesn’t matter. The main point is that compounding interest allows your money to make money for you by SITTING THERE. You can watch Netflix and your $$$ will keep growing if you LEAVE IT ALONE.

LET ME BE CLEAR-THIS WORKS FOR EVERYONE.

Taking advantage of compounding interest is NEVER a bad idea. You can argue and say “Well, I need my savings in 5 years! Investing is risky!” And that could be right-but you can also take advantage of compounding interest in a savings account, CD, whatever you choose based on your own situation.

Want to see how it works and play around with the idea? There are tons of fun little calculators that you can try. This is the one I like.

https://www.bankrate.com/banking/savings/compound-savings-calculator/

You can enter how much $$$ you have, what you want to contribute and over how long. When it asks for the interest rate:

If you have your $$$ in the stock market-

7% is the average over time

6% if you roll a little more conservatively

and if you are using CD’s or high interest savings accounts, use 4%.

Play around with it. I hope you love it and it gives you a clear vision of how powerful this can be in your financial journey.